Often when you talk with owners who made a failed attempt to sell their own businesses, most wish...

Understanding Your Buyer to Position Your Business in the Best Light

The process of business transitioning is an art, not just a transaction. And by developing your business transition plan, you have the power to create the art. Once you’ve determined your goals, quantified your financial needs, improved your business value, and understand your options, the art is in how you manage the transaction to ensure a successful outcome. This involves understanding what different buyers are looking for so you may position your business in the best possible light. Here are some things you will need to do:

- Understand your prospective buyers and what they consider attractive

- Determine what is attractive about your business in light of buyers’ unique considerations

- Position your company to be a beauty in the eyes of the buyer

Investors are looking for future return on investment and growth potential. Remember to emphasize the business growth potential rather than dwell on past performance. Growth opportunities, reputation and industry leadership are some of the many tangible qualities investors appreciate. Documenting improvements that can be made with new capital helps you to position the company better and can increase value substantially.

Investors are evaluating a potential purchase based on growth potential and expected return. Provide them with a package that includes clean historical financials, 3-5 year pro-forma projections, and solid research to substantiate growth potential.

There are thousands of very quiet private investment groups and offshore investors that are interested in acquiring profitable U.S. based, privately held companies. The world is now your marketplace, and your buyer may be anywhere in the U.S or around the world.

Your potential buyers may include:

External Buyers:

- Synergistic / Strategic Buyer

- May be a customer, competitor, supplier / vendor

- Will be able to increase sales, reduce costs, increase profits immediately

- Financial Buyer

- Doesn’t have immediate synergies

- Needs all of your people and overhead to run the business

- Private Equity

- Has capital to invest for future growth and sale

- Allows you to keep some ownership in your business

Internal Buyers:

- Your own Managers, Employees, or Shareholders who want to buy you out and operate the business

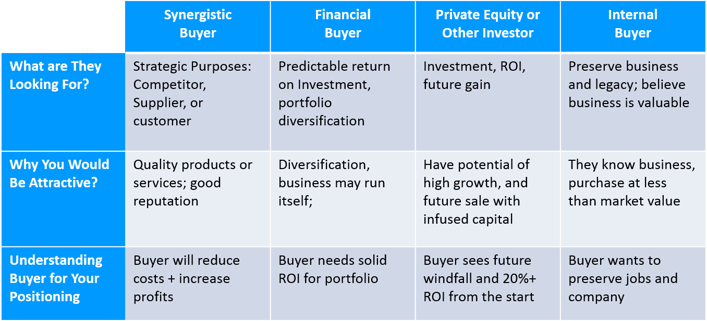

The following graphic shows a comparison of prospective buyers:

When you have done your “homework”, your intermediary will create the package that usually includes:

- Presentation of your “value story”

- Corporate structure, or chart, succession team

- Historical financials and growth horizon

- Customer and Vendor concentration

- Unique values (i.e., intellectual property, real estate, etc.)

- Market position

Buyers are often found through existing relationships you may have or intermediaries who represent sellers in finding the right buyer. All of the work you’ve done on positioning and packaging your business will help you to find the “right buyer.” A few other things to keep in mind:

Confidentiality: You must treat your potential transaction as highly confidential, never discussing a potential transition, and/or divulging any company information to any outsider at any time in this process. In all cases, the intermediary must be used to convey any and all information.

Business valuation: Whether you think that your business is worth $5M or $50M, remember to seek a professional opinion for reference prior to discussing or justifying a selling price.

Negotiating: One cardinal rule of negotiating is to never be the first one to mention price. An experienced acquirer who sees the value potential, may have a higher price in mind. Always let the prospective buyer be the first to mention price.

Start Your Business Transition Planning

Make 2016 the year that you start working on your business transition planning for what may be the largest financial transaction of your life.